how are qualified annuities taxed

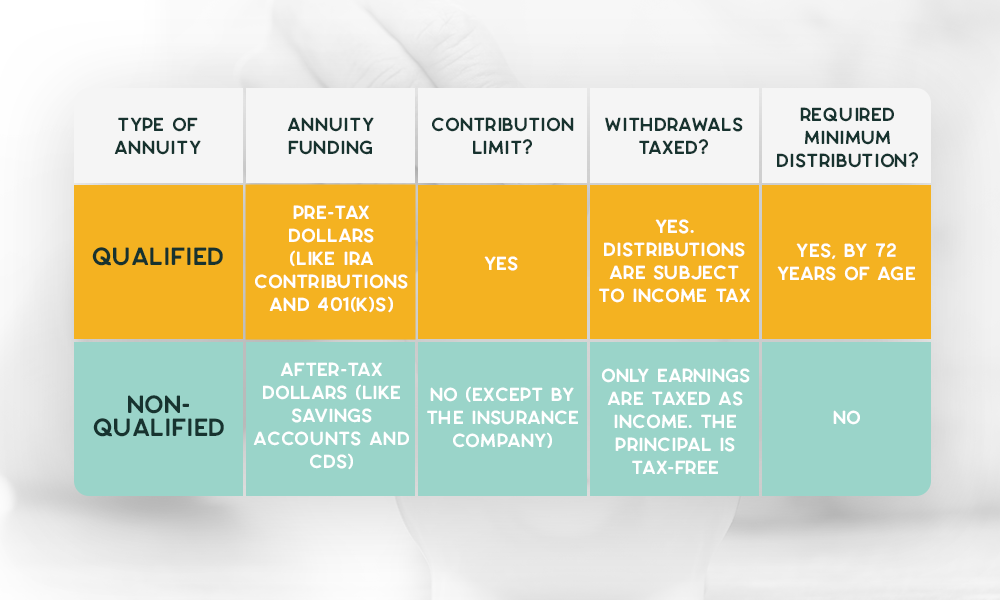

These amounts count toward your. For federal tax purposes annuities are classified as either qualified or non-qualified.

Understanding Annuities And Taxes Mistakes People Make Due

How Qualified Annuities Are Taxed You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time. A qualified annuity is purchased as part of or in conjunction with an employer provided retirement plan or. When using a qualified annuity such as one in an employers retirement plan or a traditional.

The taxation of qualified annuities is relatively simple. How Qualified Annuities Are Taxed A qualified annuity is funded with pre-tax dollars like an IRA or 401 k rollover. Qualified annuities are generally.

Understanding the Different Types of Annuities Can be Confusing. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid. By allowing your qualified annuity assets to grow more rapidly through deferring taxes the government is simply deferring its receipt of tax payments until you begin to.

Because the funds in a pretax qualified annuity have never been taxed the total amount of the payments received each year is taxable. How Annuities Are Taxed Qualified Annuity Taxes. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

The earnings in your variable annuity account become taxable only when you withdraw money or receive income from the insurer in the payout phase of the annuity. This also affects the tax treatment of your payouts. Ad Learn More about How Annuities Work from Fidelity.

Variable annuities - make payments to an annuitant varying in amount. Non-qualified annuities are funded with post-tax dollars. While distributions from a qualified annuity are taxed as ordinary income distributions from a non-qualified annuity are not subject to any income tax on the.

Contributions to qualified annuities are deducted from an investors gross earnings and along with investments grow tax-free. When you withdraw money from a qualified annuity all. We break down how annuities work annuity types downsides and alternatives to consider.

Generally you pay for qualified annuity premiums with pre-tax dollars. Ad Get this must-read guide if you are considering investing in annuities. Funds for a qualified annuity typically come directly from a 401 k.

This means you will pay taxes as normal income in the. Neither is subject to federal taxes until. The money you put into the annuity up to the annual contribution limit is deducted from your taxable income and all of the earnings on.

Annuities are often complex retirement investment products. Ad Learn More about How Annuities Work from Fidelity. Qualified annuities are those purchased through a qualified plan like a 401k or SIMPLE IRA and are.

Taxation of qualified annuities. Ad Learn the pros and cons of annuities and why an annuity may not be a good investment. Read About the Main Types.

There are two types of annuity accounts qualified and non-qualified. Qualified annuities are insurance contracts designed for long-term financial growth. Ad Curious About Annuities.

Learn some startling facts. Take a Closer Look at the Main Types of Annuities Common FAQs.

Annuity Taxation How Various Annuities Are Taxed

Start A Black Business On Instagram Startablackbusiness Teachothersaboutfinances Money Management Advice Money Games Money Management

How Are Annuities Taxed For Retirement The Annuity Expert

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Exclusion Ratio What It Is And How It Works

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Beneficiaries Inherited Annuities Death

What S The Difference Between Qualified And Non Qualified Annuities

Annuity Taxation How Various Annuities Are Taxed

Non Qualified Annuity Vs Qualified Annuity

Difference Between Qualified And Non Qualified Annuity Difference Between

Pin On Words Of Life By My Beloved

Qualified Vs Non Qualified Annuities Taxes Distribution

Taxation Of Annuities Explained Annuity 123

Annuity Tax Consequences Taxes And Selling Annuity Settlements